All Categories

Featured

If you're mosting likely to make use of a small-cap index like the Russell 2000, you may wish to stop briefly and think about why a good index fund business, like Lead, does not have any type of funds that follow it. The factor is due to the fact that it's a lousy index. Not to mention that changing your whole policy from one index to another is barely what I would call "rebalancing - universal life company." Cash value life insurance policy isn't an appealing asset course.

I have not also addressed the straw guy here yet, and that is the truth that it is reasonably rare that you actually have to pay either taxes or significant commissions to rebalance anyway. I never have. Many intelligent financiers rebalance as long as possible in their tax-protected accounts. If that isn't fairly sufficient, early accumulators can rebalance purely using new contributions.

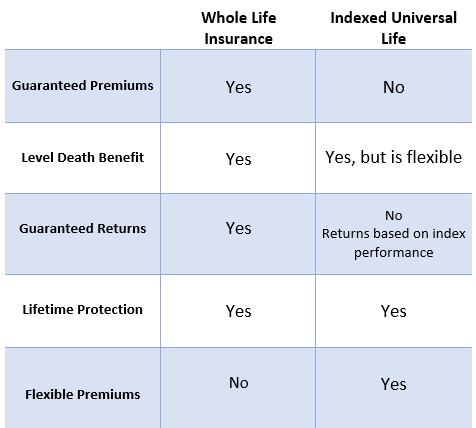

Equity Index Universal Life Insurance

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

And of training course, nobody ought to be getting packed common funds, ever. It's actually also bad that IULs don't function.

Latest Posts

Universal Life Vs Term Insurance

Universal Life Surrender Value

Pros And Cons Of Indexed Universal Life Insurance